Lessons Learned With Our First Vacation Property - Part 1

- Nick Christian

- Feb 1, 2022

- 11 min read

Updated: Feb 2, 2022

This last weekend was a special one for our family: we officially closed on our first vacation rental property! The journey came with many challenges. There was laughing, crying, yelling, and whimpering throughout. The process of finding, vetting, and purchasing short-term rental properties can easily be overwhelming, so we wanted to share what we’ve learned along the way.

This article covers everything from:

reasons we’re purchasing a property now

what type of property we were looking for

prequalifying for a loan

finding a good real estate agent

placing an offer

choosing a mortgage company

and buying points on your loan.

This article is the first of a series in which we share our experiences with owning a vacation property and everything that comes with it. If you’re considering purchasing a vacation property to use for your family and making some short-term rental income with it, follow our financial journey through our series.

Why We Bought an Investment Property Despite Unfavorable Market Conditions

We had talked about buying an investment property that pays for itself through rental income for years, but we only ever got as far as a subscription to the Discovery Channel to watch home improvement shows. We dreamed of eventually owning a valuable asset that we could also enjoy with the family. Over time, we hoped to have a handful of properties that could be an essential part of our retirement strategy.

So why did we suddenly go for it now? The second year of a global pandemic with ever-rising real estate prices hardly seems like the appropriate time to finally pull the trigger.

To be honest, we ran out of excuses.

Early on, both time and money were in short supply. On top of that, the most notable element we lacked was confidence in taking on a project we found intimidating.

You know that friend or family member that is great at fixing things around the house when something goes wrong?

Yeah, that’s not me. I wish it were.

It is easy to find reasons not to take the plunge: we were in a seller’s market, we didn’t think we’d have the time, or we were nervous to spend the money. In the end, we asked ourselves if in 10 years we looked back at this moment, would we regret not having taken the chance?

The answer was a resounding YES! In truth, we had already regretted not having pulled the trigger several years ago. We were as ready as we’d ever be.

The Type of Property We Were Looking For

My wife and I sat down to discuss what we were looking for in an investment property. For one, we were not interested in just being landlords. We wanted a property to enjoy for ourselves—a place to get away from it all for relaxing weekends. We also wanted to find a place that was appealing to others as a short-term rental on sites like Airbnb and VRBO to help pay mortgage and maintenance costs.

Our checklist looked like this:

What Could We Afford?

After the national mortgage crisis, many banks have limited mortgage payments to 28% of your gross income. Even these approval amounts can be overly generous. Gross income (before taxes and deductions) is not very helpful when you’re looking at your budget since much of that money is taken from your paycheck before it ever hits your bank account. This is a surefire way of overestimating how much you can afford. Net income (after taxes and deductions) is your take-home pay, which gives you a much more accurate representation of the cash available to you every month.

When we were buying our first home and going through the preapproval process, we were surprised at how much we had been approved for. It’s easy to look at that number and say to yourself, “Well, if the bank thinks I can do it, maybe I have more room in my budget than I thought.”

Do not fall into that trap!

In most cases, loan officers receive a commission on the total value of the loan. The bigger the loan, the more they profit. That means that your mortgage lender is incentivized to get you to spend more. It is up to you to decide how much you can truly afford. Aim for a smaller percentage than the 28% of your monthly gross income that many banks allow.

For us, as this is a second home in addition to our primary residence, we wanted to keep the monthly mortgage payment, homeowners insurance, and taxes around 10% of our monthly net income.

Don’t Put Down an Offer Before You’re Preapproved

In today’s real estate market, home sellers have the advantage. An attractive home is not often on the market for more than a week, and many buyers are paying more than the asking price. A nice cabin with some land in the Midwest is even more difficult to find right now than a traditional single-family home.

Once you find a property that is perfect for you, you need to be able to move quickly on an offer. The most effective way to do this is to get prequalified for your loan through a mortgage company before you start visiting properties.

Prequalification and Preapproval

There is a difference between prequalification and preapproval for a mortgage. Prequalification is asking a bank to estimate how much you may qualify for. You provide the bank with basic information regarding your income, debt, and estimated credit score, and they will provide you with an estimated approved amount for a loan. You can knock out a prequalification letter in a few minutes with an online mortgage company. Better and Rocket Mortgage are two of many examples of sites that will provide you a letter in under 5 minutes.

Preapproval, on the other hand, is more than an estimate. It is a conditional offer from a lending institution that they agree to lend you the funds if certain requirements are met. To receive approval of your loan, you will go through what is referred to as underwriting. This is the process in which they verify your income and debt to evaluate your financial picture.

It is important to prepare yourself for the underwriting process mentally. It can be exhausting with all the back and forth that takes place regarding documentation requirements.

The silver lining to this stress-inducing process is that this is a great opportunity to organize all your financial information, such as logins, account information, and balances in one place so that this information can be easily accessed moving forward.

Once you are pre-approved, you tend to move to the top of the list over other prospective buyers if there are multiple bids on a home.

If there are similar competing offers on a home you are selling and only one of those offers have been pre-approved by a bank, which one would you choose?

Several homes that we looked at recently would not even let you visit the property unless you had a prequalification letter from a mortgage company.

Finding a Good Real Estate Agent

We initially looked at a few houses without a real estate agent. We set up several appointments to see homes, and one agent, in particular, was very responsive and easy to talk to. Although we did not purchase the property she showed us, we found her to be very personable. In addition, her focus was working with rural properties which sounded perfect. We asked her to represent us moving forward in our search. A decision we would later regret.

Here are a few tips when searching for a professional real estate agent to avoid our mistakes:

1) Verify Credentials: You’ll want to ensure that your real estate agent is licensed by the state. You can run a google search for “[your state] real estate commission” and once you find the relevant local site you can enter the agent’s name or license number.

2) Use the Friends and Family Network: A good place to find a real estate agent is through friends and family who have experience working with one. Do you know anyone who has recently bought or sold a home? Consider asking them for a recommendation.

3) Relevant Experience: You’ll want to ask about the agent’s experience. For example, we wanted a real estate agent who specialized in rural properties.

4) Real Estate Commission: How much will the real estate agent be paid? Typically the real estate commission from a home sale is 5% to 6% of the purchase price. The buyer’s and seller’s agents customarily split the commission 50/50. If you’re selling a home, you may be able to negotiate the rate down. As the buyer, you can request a rebate of part of the agent’s commission upon closing. Just don’t be surprised if the agent won’t negotiate below the standard 50/50 split on a 6% commission.

5) Call References: You can ask for references from an agent’s most recent clients. This can save you headaches down the road by asking about the agent’s responsiveness to questions and their communication throughout the buying process.

So where did we go wrong?

Well, we skipped the part on checking references or using an agent that has been vetted by family or friends. This resulted in us:

having to sign the same documents multiple times due to errors and omissions of the correct description of the property and the wrong dates for closing.

an inspection report for the septic system that we later discovered was fabricated and never completed. We had someone run out there and complete the inspection the night before we were due to close.

we never received the keys to the property upon closing. Keys were sent to the wrong address and we had to wait several days to get them

overpaying for title work due to a mixup with our agent regarding the survey

In the end, communication fell apart and we had to rely on the seller's agent to help us through the final few steps. It was apparent that our real estate agent was focusing on other priorities she was attending to.

Agreements and Expectations

Once you choose a real estate agent, they will most likely have you sign a contract that basically states that you agree to work exclusively with that agent to purchase a home. Two of the most critical pieces of the contract are the commission the agent will receive and the duration that the agent will represent you. Many agents will default that time to several months.

This is normally not in your best interest since you might be stuck with an agent you no longer want to represent you.

Consider limiting the terms to 30 or 60 days. If your agent has not been successful in closing a deal, you will have the opportunity to find another agent when the contract expires.

Choosing A Mortgage Company

Reaching out to multiple mortgage companies and having them bid for your business is not only prudent, but it can save you tens of thousands of dollars. Homebuyers are generally discouraged from shopping around since you are told your credit score can be negatively impacted. Although a hard pull of your credit can negatively impact your credit score, the consequence is normally quite small (5 to 10 points).

You can avoid any negative ramifications by exploring your options within a short period, typically less than 30 days. Multiple hard pulls within a short timeframe only count as one since the credit reporting agencies assume you are shopping around. (You can play it even safer if you choose to compare rates within a two-week period.

Don’t let the fear of lowering your credit score stop you from shopping around for the best deal.

We reached out to a total of four mortgage companies. We decided to put down 10% on the mortgage for the cabin and use additional funds to furnish the property.

The small local bank in the area only provided loans with 20% down, so that quickly eliminated them. The other three banks provided us with a loan estimate to compare rates and fees.

Below in the dropdown is a deep dive into the loan estimate document to help you better understand how to compare rates from different mortgage lenders.

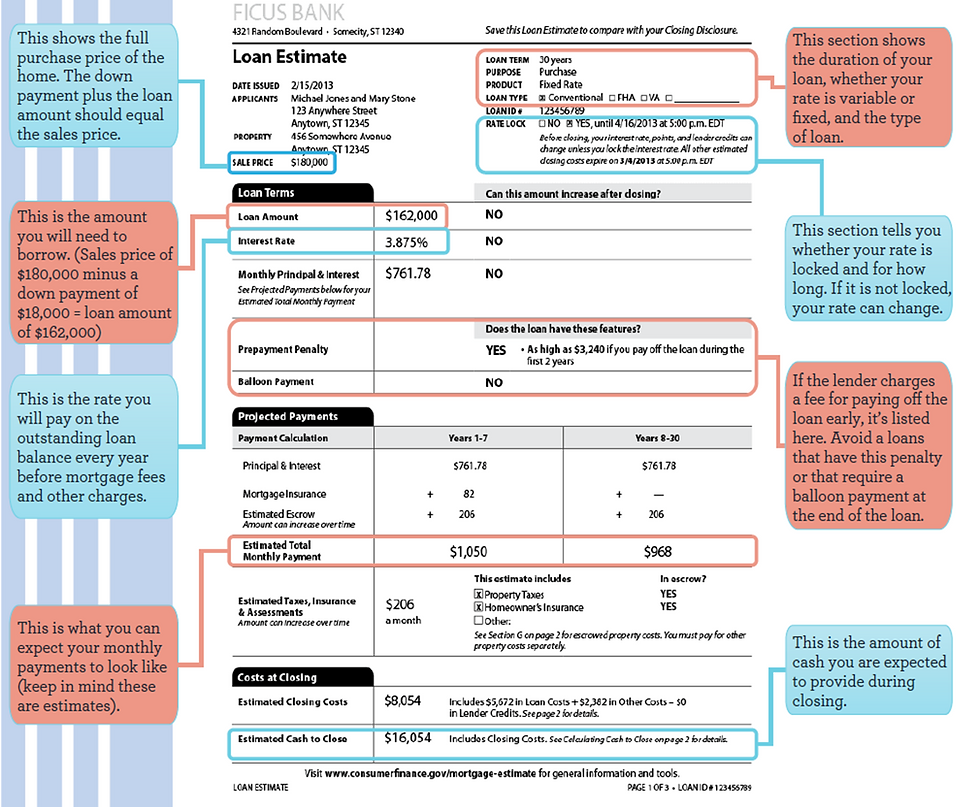

The Loan Estimate

Each mortgage company should provide you with a loan estimate like the one shown below. These loan estimates are three pages long and are required by the Consumer Finance Protection Bureau to be in the same format.

This makes loans easy to compare. It is important to get familiar with the information in the loan estimate to accurately compare loan offers.

Interest Rate Vs. APR (Annual Percentage Rate)

There is an important difference between your interest rate and your annual percentage rate (APR). The interest rate listed on page one of your loan estimate is the interest you will pay on the outstanding amount of the loan each year. This rate does not include bank fees and other charges. Your APR, listed on page three, is your true cost of borrowing. Your APR is your interest rate in addition to the bank fees and other charges listed. This will give you a full picture of the interest you will pay on the loan.

Personally, we have been disappointed at the number of agents that are very dismissive of the APR and try to get you to focus on the interest rate alone. Of course, that would be ignoring the fees the bank charges you for the loan.

When speaking with lenders, make sure they provide you with a complete picture of your actual monthly mortgage costs. You’ll want to make sure the estimate includes homeowner’s insurance, property taxes, and private mortgage insurance (PMI) if you are putting down less than 20% down.

Trulia has an easy-to-use calculator that includes all the estimated fees you can expect. For an apples-to-apples comparison, make sure the loan amount on the document is the same across all lenders.

So back to the cabin…

For us, the choice between lenders boiled down to the company offering the lowest interest rate with the least amount of closing costs along and without penalties for early payoff. In the end, both Rocket Mortgage and Ally Home Loans had matching competitive rates, so the decision came down to closing costs. I sent both companies each other’s competing loan estimates and asked them to beat that offer.

A couple of emails later, we had saved over $1,600 in closing costs.

On two separate occasions in the past, our lenders made last-minute changes and increased our interest rate when purchasing a home. We can’t be certain, but we felt that the bank assumed we would simply accept the increased rate since we were in the middle of the approval process, and looking elsewhere would involve too much effort. On both occasions, we told those lenders to kick rocks and went with other lenders that provided better rates.

We always recommend going through underwriting and providing documentation to two separate mortgage companies. Get a pre-approval from both before having to pay any bank fees, such as the appraisal. If the lender comes up with some technicality all of a sudden and can only offer you the loan at an increased rate, you’ll be in a position to drop them quickly and go with the competing offer.

What Does It Mean To Buy Points on Your Loan?

Buying points essentially means you pay money upfront to lower your interest rate. You can find this in the first section on page two of your loan estimate.

Normally a point costs 1% of the amount you’re borrowing. So, if your home loan is $200,000, a point would cost you $2,000. That $2,000 generally lowers your interest rate on your mortgage by 0.25%. Usually, you can purchase up to three points. The discount rate and the number of points available will vary from lender to lender.

You should ask yourself two questions to determine if buying points is a good idea. The first and most practical question to ask yourself is: “Can I afford to buy points?” Most of us can barely come up with a down payment, so the additional money to buy down the interest is difficult for many.

If you can answer that question affirmatively, your next question should be: “How long do I plan on living in the house?” The longer you plan on living in the home, the more it makes sense to pay for discounted points to lower your interest rate. The benefit of lowering your interest grows with time. If you’re planning on selling the house in a few years, the situation changes.

Calculating your breakeven point will help you to determine whether you should buy points. This is the juncture at which buying points to lower your interest rate becomes cheaper in the long run. If you are considering buying points, NerdWallet has a helpful calculator to help you determine whether or not it will be the best option for you.

https://www.nerdwallet.com/article/mortgages/should-i-buy-points-mortgage-calculator

Negotiating for the Perfect Place…Again

After a couple of weeks of searching, we came across a beautiful cabin. We thought it was perfect and decided to place an offer on the home. Over the years, we had become accustomed to negotiating. We offered around 10% below asking and expected the seller to meet us in the middle.

But, this was a different real estate atmosphere than we were used to.

That same day the house was under contract — and it wasn’t with us.

We had been beaten out. It was disappointing, to say the least, and a wake-up call that we were in a new real estate environment in which home sellers had the advantage.

We dusted ourselves off and got back to looking online and in person.

About a week later, we received an unexpected call.

One of the properties I had called about a few weeks earlier had come back on the market. When I had initially called, I found out the home was under contract. I had left my contact info with the agent in case something changed, never expecting to hear back.

My wife and I went to see the property first thing in the morning. It was a beautiful cabin with lots of land and within our budget. The agent was showing the house to two other prospective buyers that day, so we decided to move quickly and place an offer on the home.

I’ve always been keen to negotiate for great deals, so it was a hard pill to swallow when we decided to offer the asking price. After the emotion of the moment had passed, I accepted that even offering the asking price was a reasonable negotiating tactic in this environment.

Then, crickets…

We did not hear a word for two days. We had made the offer valid for 48 hours, and in what seemed to be the last minute of the last hour, we got a call.

They had accepted our offer!

After spending years paying for weekend getaways on Airbnb and VRBO, we finally had a vacation property for ourselves! The excitement felt a bit muted though. Honestly, with all the issues during the closing, (such as not getting the keys to the property after closing), we weren't able to sit back and really enjoy what we had done that first day. Our daughter in the picture does well to describe our mix of emotions.

Happy, confused, relieved, and exhausted.

In the next article of this series, we’ll be discussing marketing your property on Airbnb and VRBO, and forming a business around your rental property for considerable tax breaks.

…to be continued

Comments